Volume VI, #26

In her new book, The Nine Of Us: Growing Up Kennedy, Jean Kennedy Smith, the last surviving sibling of John, Robert and Teddy Kennedy, tells a great story. One day Jean stole a cookie and her mother Rose locked her in a closet as a consequence. Jean recalls being in the closet for an abnormally long period of time. Then the door opened and Rose pushed Teddy in – punishing him for a different infraction. Once again, Rose shut and locked the door. Rose Kennedy had forgotten Jean was in there.

It’s hard to keep track of two children, let alone nine. And last week we found that the U.S. Department of Education (ED) had trouble keeping track of $108 billion – arguably harder to lose than a child or two.

***

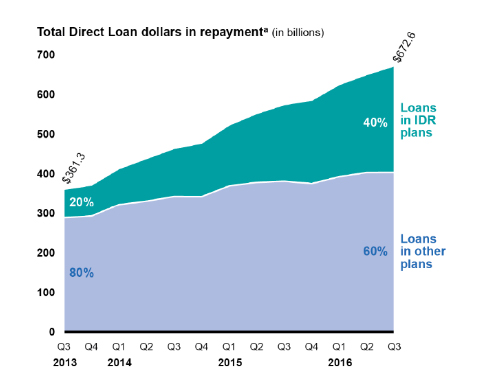

Thanks to major efforts by ED to push federal student loan borrowers into Income-Driven Repayment plans (IDR), the percentage of IDR borrowers has jumped from 10% to 24% in the past three years, (now 5.3M in total), and the percentage of outstanding federal loan dollars being repaid through IDR doubled over this period, from 20% to 40%. In 2016, ED set a new goal of adding 2M more borrowers to IDR in the next year.

ED is required by law to provide an annual estimate of the long-term subsidy cost of the federal student loan program, for inclusion in the President’s budget. That cost is simply the amount of loans disbursed, less the net present value of repayment cash flows to the government over the life of these loans. But according to last week’s timely GAO report to the Senate Budget Committee on the actual cost of IDR, ED’s student loan cash flow model was so simple it underestimated the subsidy cost of IDR by billions.

In a prescient August op-ed in the Wall Street Journal, “Writing Off Student Loans Is Only a Matter of Time,” University Ventures Managing Director Daniel Pianko came remarkably close to estimating the actual subsidy cost of IDR: 20% vs. the GAO’s 21%. The GAO report also directly answered Daniel’s question: a Matter of Time = 3.5 months.

According to GAO, the reasons for ED’s “misunderestimate” include:

1) Assuming no growth in the number of IDR borrowers – remarkable, considering soaring growth in the program and the new target of adding another 2M in the next year.

2) Failing to count Grad PLUS loans in the cost.

The fact that ED failed to review its model, run sensitivity analyses, or hire an independent firm to check the work explains why these mistakes weren’t caught until the GAO took a look. ED’s official response to the GAO report has been that “the decisions made… were based on existing staff and systems resources available.”

There’s no question that the college affordability crisis has now fully morphed into a student loan repayment crisis, as the GAO report notes, “almost 20 percent of Direct Loan borrowers were delinquent on their loan payments at the end of 2015, and more than a million borrowers defaulted on their loans over the 2015 fiscal year.” Undersecretary Ted Mitchell pointed this way in his statement on the GAO report: “IDR plans also help keep borrowers from financial strain and reduce default, which can wreak havoc on struggling families' credit rating and ability to get back on their feet.” But as Alexander Holt of the New America Foundation noted in Inside Higher Education, ED’s approach to calculating the cost of IDR “is insane incompetence.”

***

While Rose Kennedy eventually looked in the closet for her kids, the higher education press hasn’t gone looking for the $108 billion; The Chronicle of Higher Education hasn’t published more than a news brief on the GAO report, let alone an investigative report. Which begs the question: how is it that The Chronicle reports extensively on one college spending $250k on a table, or $175k on preserving a school’s online reputation, but not on billions of dollars resulting from the most radical shift in student lending policy accomplished solely by regulatory means?

It could be that some higher ed. brains turn to mush when it comes to finance. But I think it’s mostly due to the Robin Hood effect: crime doesn’t seem so bad when it’s robbing the rich to give to the poor. There’s no question that many college grads (particularly recent grads) are weighed down by student debt. This is the logic employed by a number of Democratic Senators who now militate for automatic loan forgiveness for all students the moment any for-profit college closes down. But this thinking is flawed in two ways. First, it’s akin to saying “Jean did something really bad,” so therefore Rose is excused from forgetting she locked Jean in the closet: the one doesn’t have much logical connection to the other. The second is that, in many cases, IDR steals from taxpayers to give to well-off students. IDR not only inordinately benefits students who borrow for graduate school (where loan limits are much higher), it benefits the most savvy borrowers who understand that the 20- or 25-year repayment term available via IDR is much more attractive than the 10-year direct loan repayment term.

There are lots of things the government can do for Millennials struggling to repay their student loans. But being as careless as Millennials were in taking out student loans in the first place is neither an optimal nor acceptable solution. How can we expect students and colleges to be fiscally responsible when ED isn’t and the higher education press isn’t interested?

The Obama Administration can rightly point to a number of important achievements in higher education. Foremost among them in my view, is the College Scorecard, which busts the input-centric college rankings racket by providing outcome data (graduates’ incomes) on an institutional level. In time, the College Scorecard may come to be seen as the dawn of a new era of accountability, where sunshine will prove to be the best disinfectant.

This makes the GAO report on IDR an ironic last chapter for this Department of Education. The Obama Adminstration’s first actionable higher education priority was to attack for-profit colleges for “predatory” behavior that the industry characterized as careless, but not intentional. This last chapter is a Bizarro-version of the first chapter, because while ED writes it off as careless, it’s more likely a calculated effort to achieve “free college” by regulatory fiat rather than the appropriate legislative processes.

The IDR scandal is also ironic because income-based repayment is highly likely to become an important Trump Administration initiative for furthering college accountability – ensuring that each and every college that pulls down federal student loan dollars has “skin-in-the-game.” It is an historic whiff that Obama’s Department of Education failed to use income-based repayment to advance its accountability agenda rather than its free college agenda.

University Ventures (UV) is the premier investment firm focused exclusively on the global higher education sector. UV pursues a differentiated strategy of 'innovation from within'. By partnering with top-tier universities and colleges, and then strategically directing private capital to develop programs of exceptional quality that address major economic and social needs, UV is setting new standards for student outcomes and advancing the development of the next generation of colleges and universities on a global scale.

Comments